Dan Zanger Says... Follow the Leader

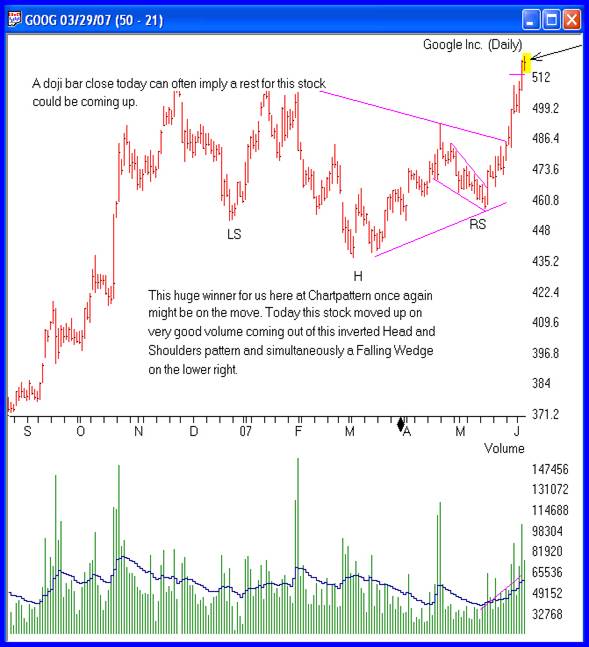

The Stock Master Shares His Secrets By Matt Blackman Zanger first came to public attention when he was featured in a Fortune magazine article in December 2000 entitled, My Stocks are Up 10,000%! The truth was even more amazing. He became the unofficial stock trading record holder in 2000 by transforming a $10,775 investment into $18 million in 18 months, which actually worked out to 164,000% in a year and a half. In 23 months his market nest egg had grown to a mind-boggling $42 million. He even has the tax receipts to prove it. The pool contractor turned millionaire had developed quite a following in the process during the bubble heyday. On any given weekday from 1998 through 2000, you could find Zanger glued to his computer screens with laser focus surrounded by a half-dozen friends watching his every move on occasions. Without saying a word, he would remain poised like a hawk watching 40 – 60 stocks and waiting for the all-important breakouts from patterns on volume, calling his broker to buy and sell a stock when the time was right. This would go on from market open to market close. His audience would do their best to follow his every move in silent amazement. Today they are gone and he trades solo for the most part. Most of his friends just didn’t have the stamina or commitment, especially when the going got tough. What did he talk about at the seminar? Much of the day was spent examining chart patterns and daily bars, but more importantly, seminar attendees had a chance to hear a detailed post mortem on each of his largest and best winning trade of the past 7 years. When asked what are the keys to his incredible success, he simply replies, “chart patterns and volume, that’s pretty much it.” Volume is the real key for without a strong surge in volume, even the best pattern breakouts won’t go anywhere. Sounds simple but like all great success stories, it’s not so easy. Those who subscribe to his newsletter, The Zanger Report and his member’s chatroom at Chartpattern.com quickly learn that it took Zanger years to become an overnight success. His clients range from private traders with small accounts to hedge fund managers trading millions and possibly billions of dollars and numerous clearing and trading houses. Want to spend a day watching him trade? He doesn’t say much, especially when the market is really moving, but he is only too happy to share his many secrets when he has a spare minute between scanning more than 60 stock charts and watching for volume breakouts on another stock list. That will set you back $5000, but his students know they will always get their money’s worth. His system is not for the faint of heart. As Dan says using a racecar analogy, “I like to drive at 180 miles-per-hour inches from the wall,” when describing his high velocity 2:1 margin trading style. He is constantly on the lookout for the high beta movers he calls his “frisky buddies.” “I want to find the market leaders, the up and comers and I only trade them. If it’s not moving higher, I’m not interested.” Contrary to popular practice, he steers clear of bargains. “Why buy a stock that will go up $5 or $10 if you are lucky when there are stocks that will move $30 - $50 in the same time frame?” Figure 1 – Google, one of Dan Zanger's regular favorites, has been featured in countless issues of his Zanger Report issued 4 times per week and holds the record of his single most profitable trade and largest holding. Here we see his analysis and notes on the chart patterns the stock is exhibiting. Provided by chartpattern.com Mixing It Up: Technicals + Fundamentals = Consistent Winners Zanger takes a top-down approach when looking for stocks to buy. First he looks for stocks putting in "interesting chart patterns on increasing volume." If the stock is acting frisky, there is generally a fundamental reason why; often institutions are accumulating the stock and the chart pattern is simply proof of this. A one-time student of William O’Neil, founder of the Investors Business Daily newspaper dynasty, Zanger has paid his dues. He spent more than 10 years logging 20 or more hours per week (on top of his day job) studying chart patterns. Like a Top Gun fighter pilot looking at enemy aircraft silhouettes until they can identify them in their sleep, Zanger internalized a myriad of chart patterns until he could pick them out in an instant. A breed apart from most traders who are either technical or fundamental, Zanger uses O’Neil’s CANSLIM formula discussed in his bestselling book, How to Make Money in Stocks: A Winning System in Good Times and Bad. O'Neil recommends that you buy only companies exhibiting certain fundamental and technical characteristics. Zanger has added some of his own criteria, and, interestingly, he has discovered over the years that stocks demonstrating interesting chart patterns on volume very often turn out to fulfill most if not all of the CANSLIM criteria. Here is a summary of the CANSLIM criteria, including the way Zanger uses them.

Adding Some Perspective Zanger’s high-speed trading method is not for everyone. Any system that offers big potential wins also works in reverse and Dan is the first to attest to that. Get caught in a stock that does an abrupt about face and the game turns into a survival of the fastest to reach the exits. But like all successful traders, Zanger has had to learn how to limit losses while maximizing profits and he doesn’t let his bad days get him down for long. Internalizing your trading rules and patterns is also critical to success. Besides How to Make Money in Stocks, two other books that are absolute essential parts of trader education in his opinion are Reminiscences of a Stock Operator and Encyclopedia of Chart Patterns. His daily newsletter is also very useful for those who are interested in getting his input on the market and stocks making moves. It is also important to take your own personality into account. By his own admission, Zanger is a type “A” personality and needs the thrill of the chase to keep his interest. He thrives on the high adrenaline rush of trading fast moving stocks. Others might consider this stressful but it’s not just the best game, it’s the “only” game in the world to him. But then again, that describes a high percentage of successful traders. Recommended Reading

|